How should an established and renowned brand with fifty years of history

turn towards digital services to add

new value?

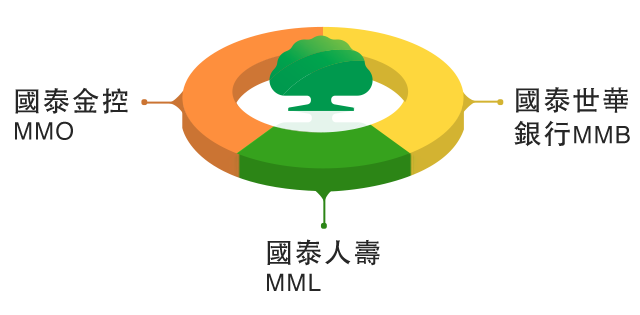

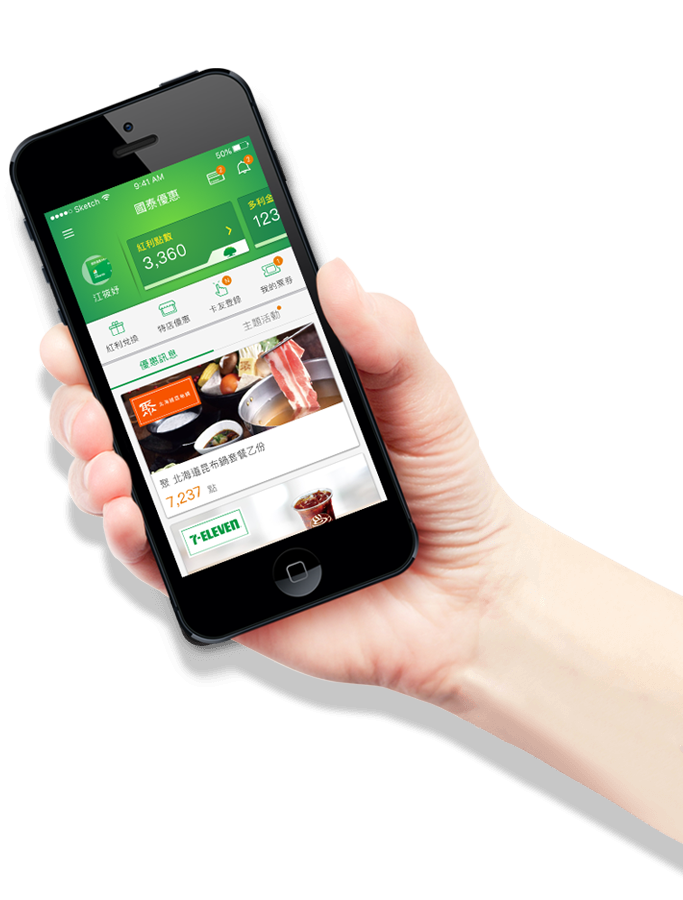

The Cathay Financial Group is Taiwan's largest private enterprise. For the past fifty years, it's image is synonymous with pragmatism, practicality, and reliability, much like an ancient and large tree. However, in the new era where mobile lifestyle is increasingly taking center stage, how can a traditional business retain the good core values of its brand and inject them into mobile service experiences through digital interfaces?

How can we bring the

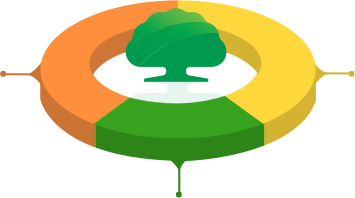

three mobile services of life Insurance, banking, deals together?

The Cathay Financial Group has a good and stable corporate image. However, when the company decides to offer mobile services (a tone that differs from its usual services), how should it strike a balance between brand consistency and service differentiation, and create high levels of customer satisfaction? This is the business challenge presented by the Cathay Financial Group to AJA.

Cathay Financial Holdings (MMO)

It is like a fellow enthusiast with common interests, who shares all he knows on places of interest, great deals, event information, and also financial and investment pointers.

Cathay Life Insurance (MML)

It offers protection like a safe haven, seeks to understand the users' needs with a warm and caring heart, and extends a firm helping hand when the customers are in need

Cathay United Bank (MMB)

In terms of finance, it always provide professional, accurate and reliable management services, and regards each customer who requires its services with rationality and pragmatism.

Instead of rushing into design, we choose to first listen to what the customers and users have to say.

Having understood the main direction for the project, we proceeded with studying the needs of the teams providing these three services. Our AJA team listened attentively to each stakeholder, from agents to the vice president, and identified their individual needs. At the same time, we also explored another perspective by actually visiting the users' homes. There, we sought to understand the circumstances, thoughts and behavior patterns with which the users downloaded and used the Apps for these three services.

We strove to completely understand the situation and context for usage and make accurate observations and conclusions.

Take the life insurance App - My MobiLife for example, through this study, we learned that users see investment-linked policies as extensions of their savings, and are therefore very concerned with profit and loss. These are some of the things the users said: "I used to check if I made any money each week; now that I'm only losing money, I don't check anymore.", "I usually check once in a week or two to see if my investment-linked policies made any money, if they have I will cash out the profits.", "Traditional policies don't change very much, and I don't check them everyday; investment-linked ones can have huge changes and so I will check (them) regularly.". After combing through all relevant contexts, we identified one observation, which is "check regularly if there are changes".

What is important for an App is not to have many features, but rather, doing one thing properly.

Having understood the needs, we kept these in mind and embarked upon the design phase. For user experience design, we first ranked the functions according to their importance to the users, with the objective of providing the users with information that they truly need, as well as more intuitive and comprehensible names and classifications. We then removed the unnecessary functions and optimized the operational experience. We aimed to allow users to take in product details at a glance and operate intuitively.

Quality is built up

from every single detail.

In terms of visual design, our highest guiding principle is to uphold an image of a comprehensive family business group. Under this style, we created three different product characteristics to extend the Cathay Pacific spirit and to create more introspective, finer and more comfortable operating interfaces.

Our greatest pride

is the users' love for the Apps!

This project started in 2012, and the updated versions of the Apps were very well received after their launch. The Cathay Financial Group conducted a customer satisfaction survey on 6000 people and results indicated that almost 95% of the respondents are satisfied. Download rates for the new versions of the Apps tripled! A good design can withstand the trials of time. From their launch in 2013 to the present day, the maintenance of these Apps only required minor updates in the details; no further large-scale modifications were required. After this collaboration, the Cathay Financial Group continued to work closely with AJA in subsequent new developments.