The key problem must be identified before we can

innovate and reverse the situation.

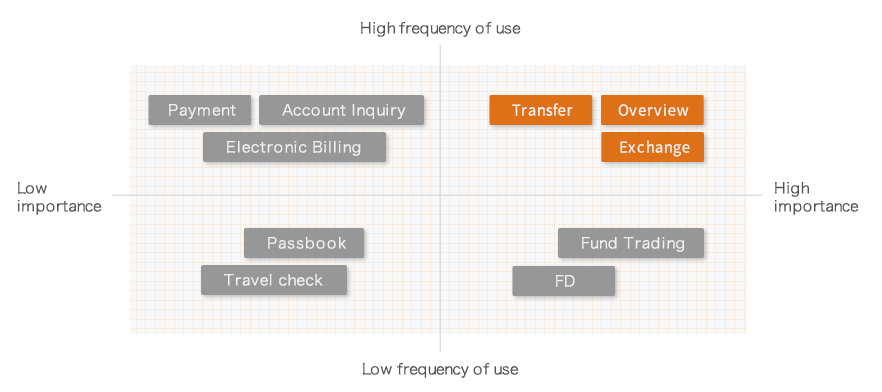

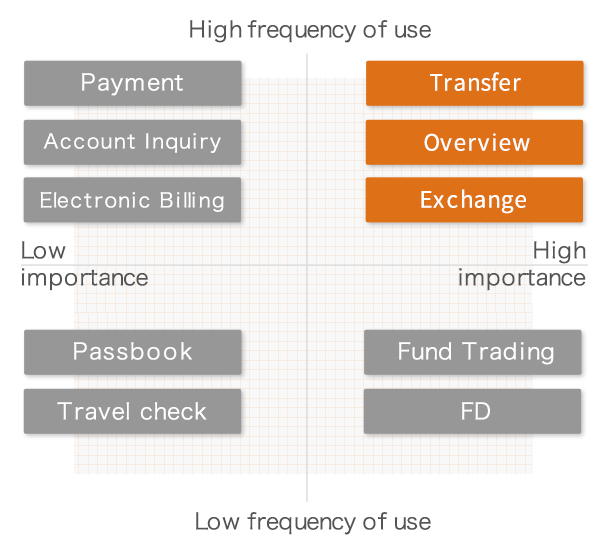

A mere visual revamp of the interface will not suffice, we need to identify the key problem. From early 2000, when the first wave of Internet banking hits the market, to the subsequent Bank 2.0, many basic services have been gradually migrated to digital platforms. With Bank 3.0, "bank" is no longer a physical place; it has become an act and service. In view of these changes, we interviewed more than 30 Internet banking users to understand their needs for a wide range of financial services, and the usage context of existing network services.

Interestingly, 70% of the respondents said they are familiar with existing Internet banking features, and had not encountered many problems in operation. Upon further probing, however, we found that, the users generally expects more from some frequently used services, such as account overview, fund transfer, and money exchange, etc., and these expectations have yet to be properly met. With every bank offering more or less the same Internet banking services, how then do we restructure the framework based on the users' perspectives, and how do we optimize each aspect? This is the key to emerging as the final winner.

Thinking out of the box, let us reconsider why

Account Overview is necessary?

From the bank's functional point of view, "Account Overview" involves the passive display of various data relating to the account; from the user's point of view, this is more of an active process of understanding himself/herself. Understanding his/her financial status, which leads to reconsideration and realignment, followed by financial management with a fresh frame of mind.

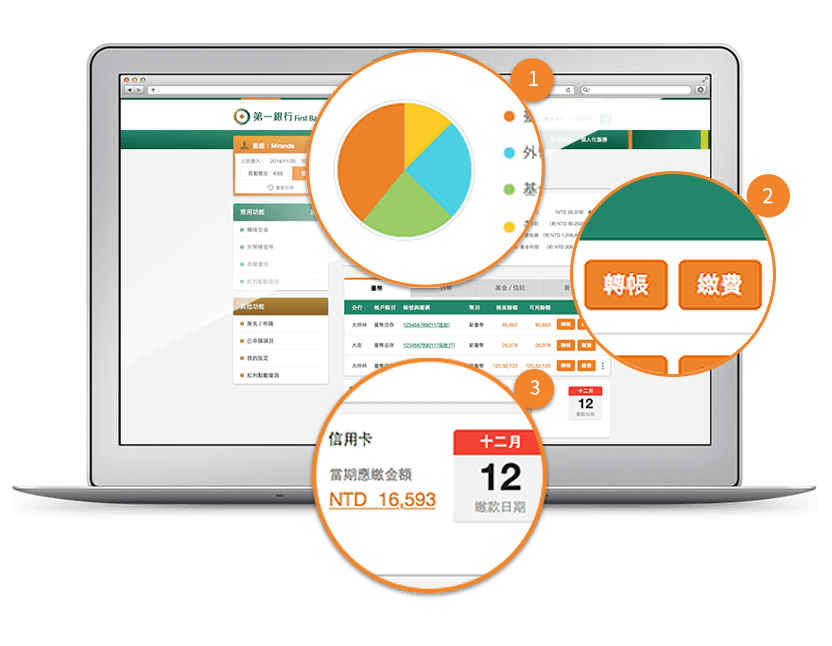

More comprehensive financial analysis

Everything about your financial status is available at a glance - from Taiwan dollars, foreign currencies, funds to gold account, all presented visually in charts and tables.

More intuitive account management

To whom shall I transfer money? Which account shall I use for fees payment? These are questions that come easily to mind. To facilitate more intuitive and simpler use, we added buttons after each account for relevant operations.

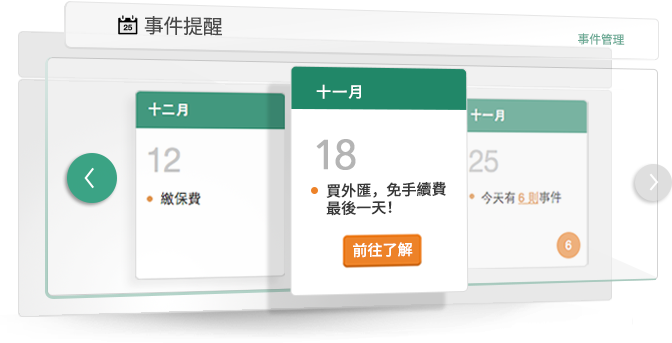

More thoughtful credit card payment reminders

Our preliminary studies show that a high proportion of users are concerned about their credit card spendings. Hence, our final design not only provides due date reminders, it also displays real-time credit card balances.

Fund Transfers & Currency Exchange -

How do we improve on these common functions?

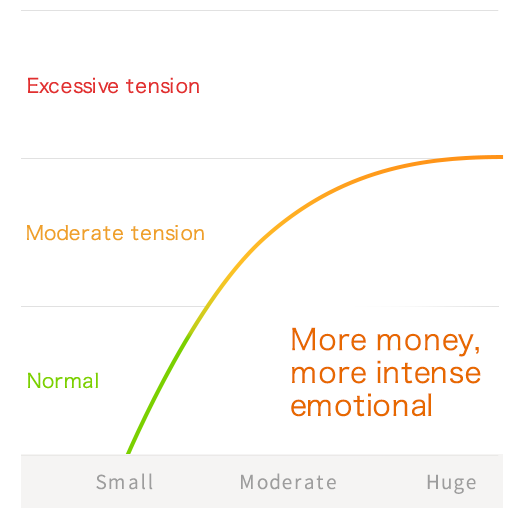

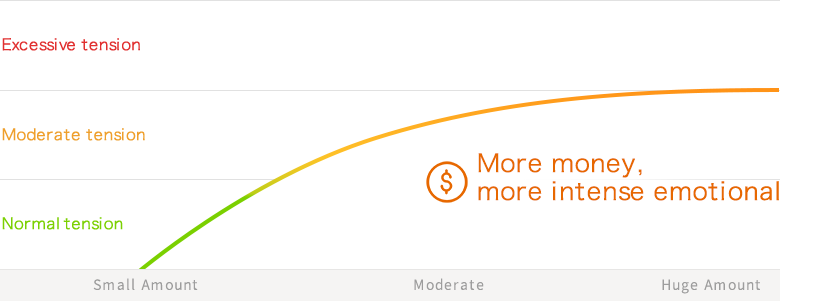

Fund transfer and currency exchange are the two most commonly used functions of Internet banking. Despite this, according to our studies, most respondents are very wary of making mistakes while performing these operations, as a slip can result in wrong a transaction value or content.

Notwithstanding this tension,

how then can we improve on the design?

A suitable amount of tension can make the user more focused and careful during operations. A good design should therefore make use of this tension to help the users focus, and complete their goals more efficiently and confidently.

A more comprehensible input format

Typically, the user is required to fill in many fields on a form for funds transfer. To help the users better focus and comprehend, we rearranged the fields into three main groups that are familiar to everyone, namely, the Source Account, Target Account and Value of Transaction.

Highlight the most important information

A lot of information is presented on the confirmation page, but the users are most concerned about the account numbers and values of transactions. We enlarged the fonts for these items and marked them with bright colors, to help the users with verification and confirmation.

A definite end point

To help ease the tension, a message emphasizing the success of the transaction will display at the end of each transaction, with clear icons and text messages.

Final design

Final results

Even a century-old brand, with rich heritage in the financial sector, has needs and opportunities for changes. Through AJA's professionalism in UX design, needs interviews, contextual analyses, concept transformations and other rigorous design processes, not only have we given new life to an old brand, we also addressed the structural aspect and helped our customer better understand the needs of a new generation of users. Finally, our design is implemented in the digital services with precision and attention to details This is a new starting point on the road of modern financial evolution, and a turning point that focuses on users.